settings

children

With Famly since

Mention numbers and finances to many nursery owners and you can see their eyes start to glaze over a little. They didn’t go into childcare in order to monitor numbers — it was all about the children and as long as the nursery was full, then everything was fine.

Wasn’t it?

Well, that may have been the case in previous years. But more recently, the early years sector has dealt with steep increases to some of our biggest costs, such as staffing and business rates. On top of that, the current economic climate has increased other costs such as utilities and materials.

That’s to say, this current economy means we’ve got to get more serious about our early years finances. Nowadays, it's easy to be full of children and yet be unsustainable financially.

So how can you ensure that you have a healthy business alongside a healthy childcare service?

A good place to start is by keeping track of your ‘red flag figures.’ These are five numbers that represent the financial health of your nursery, almost like vital signs. We’ll go through each one down below, to show how you can calculate each number, and why it’s important to understand them.

1. How do your staff costs compare to your income?

This is a very quick and simple way to gauge how your business is doing in any specific month. You don’t need a set of accounts to access it, and you should be able to get your hands on these numbers fairly quickly in order to work out how you are doing. Put simply, this number identifies how well the business is performing and if you are potentially overstaffed.

To calculate it, you’ll need just two things:

- An accurate monthly income figure, including private fees and funding for the month.

- Your total monthly staff costs, including NI and pension costs.

Take the staff costs figure, multiply it by 100, and then divide by the monthly income. The result will be the ratio, expressed as a percentage, of your staff costs to your monthly income. When you’re closer to 50% with this figure, it means you’re being more efficient with your staffing, and thereby likely making more profits. The ‘red flag figure’ is around 70% for most settings — if your staff costs are higher than that, then it’s likely there are not enough other funds to cover your other overheads and outgoings in that month.

Of course, you need to remember to include the owner’s income as well as the staff team when working this out.

2. Calculate your monthly profit levels

In order to know this figure you will need to know some more details of your actual income and outgoing, for example:

- Staffing Costs

- Consumables Purchased

- Overheads such as rent, rate, light, heat, and legal costs

If you are recording all your transactions yourself or through a bookkeeper, then these numbers should be available to you shortly after the end of the previous month.

It takes time to build up a picture of what happens over a 12 month period. But you need to start somewhere, and starting in any month is better than not knowing this monthly figure at all. By recording your income and outgoings on a monthly profit and loss sheet you can also measure the percentage spent on any aspect of the business including purchases, rent and of course staff as noted above.

By using a spreadsheet to record all of this information, you can use the formulas in Excel to start to auto-calculate various ratios for you. This might include the staff to income ratio mentioned as the first ‘red flag figure’. Of course some accounting software may be able to do this for you as well, it’s all about how accessible this is for you to be able to get this number each month.

Some months you may be making a loss, but in other months you will definitely have to be making a profit to keep in business. Knowing these tolerances in your business helps inform your next actions, as you know how much ‘wiggle room’ you have. And while this figure only tells you how you’ve fared in the past, over time you’ll be able to speculate with this data on how you might do in coming months. Then you can work to improve any loss-making months.

3. Track your monthly occupancy levels

Looking at your occupancy level alongside your monthly profit and loss can be a huge indicator as to whether you are charging enough fees to your parents. If your occupancy (which is the total number of sessions you have filled as a percentage of those that you have available in total) is high, yet your profits are low, this is a red flag that you are not charging enough to cover the costs of your delivery of the service.

This may be because you are not making up the funding gap in some way, and are relying mainly on the government's funding rates as your pre-school income. The knock on effect of this is that your own income could well be affected because there is possibly not enough left in the bank to pay yourself a proper wage. Addressing this may require a full analysis of cost and income in your pre-school to get you back on track, and come up with a plan to make the necessary changes in your billing structure.

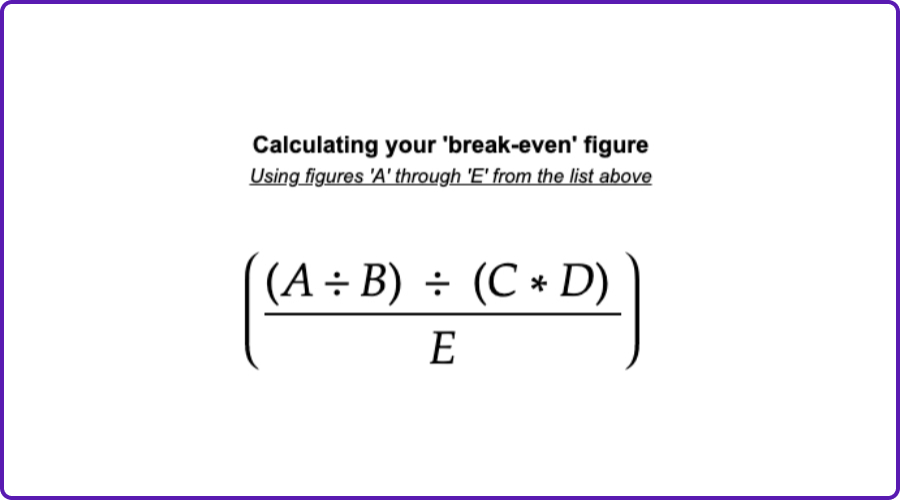

4. What’s your ‘break-even’ figure?

This is a figure that we often calculate when we set up our nursery business, but then never really revisit. In a nutshell, this is the minimum figure you need to take in order to be sustainable. If you break even you have not made a profit or a loss, but you have covered all of your costs with the income you have achieved. It can be useful to work this out for the nursery overall or even for each individual room if you can split the figures you have that accurately.

There are several different ways you can calculate your break-even figure or your hourly rate. I generally use a quick method of taking the annual costs and dividing by the number of weeks then working out my average number of sessions currently being used and dividing that into the result of the first number. Then I divide by the number of hours per session to give an hourly break-even point.

Here’s how this works step by step:

- Start with your annual costs, include everything within your profit and loss expenditure sheet. We’ll call this figure ‘A’.

- Count up the number of weeks you are open. We’ll call this figure ‘B.’

- Work out how many sessions you are open for each week. So if one session might be a half day, a full time provision may have 10 sessions. This is figure ‘C.’

- Multiply your number of sessions by the average number of full time equivalent places you have filled. You could use your total number of places, however many settings rarely fill every session on every day, so the number may be lower than your total number of places. This is figure ‘D.’

- Count up the number of hours per session. This is figure ‘E.’

5. Following your enquiries

If you are not monitoring your enquiries on a daily, weekly and monthly basis, how will you know if they suddenly drop in number? It’s essential to track:

- How many enquiries you get

- How many of these enquiries turn into visits

- How many of those visits become customers

Knowing these numbers means that when you notice a change, you can react to this quickly and address any possible issues causing that change. This might involve you doing some PR work, getting more attention on social media or undertaking more marketing activities to re-establish the number of enquiries you need to maintain your ideal occupancy levels.

But again, you won’t know to make any of those changes if you’re not tracking the numbers in the first place. That’s why it’s so important to make this a regular habit, so you’ve always got these figures on hand.

What to do when the numbers aren’t adding up

You might think of these five figures as your little flock of coal-mine canaries. Whenever one of these numbers isn’t looking how it ought to, you’ve got to react, and react fast.

At the very simplest, addressing these concerning figures comes down to 2 choices:

- Increasing your income

- Reducing your expenses

Obviously the first one is the best option, but if you can’t do that quickly then you must address the situation and look at how you can do more of the latter, even if only temporarily. Because if you don’t take some action, then you risk going down the route of unsustainability.

Tricia Wellings and the MBK Group have been helping early years practitioners get a stronger grasp of their nursery finances since 2016. To learn more about MBK Group and get resources to help your setting, visit www.mbkgroup.co.uk.

The big ideas

Top tips from Alphabet House

Get top tips from a setting just like yours. Hear from Alphabet House on why and how they use Famly - and why they’ve never looked back.

Read their story